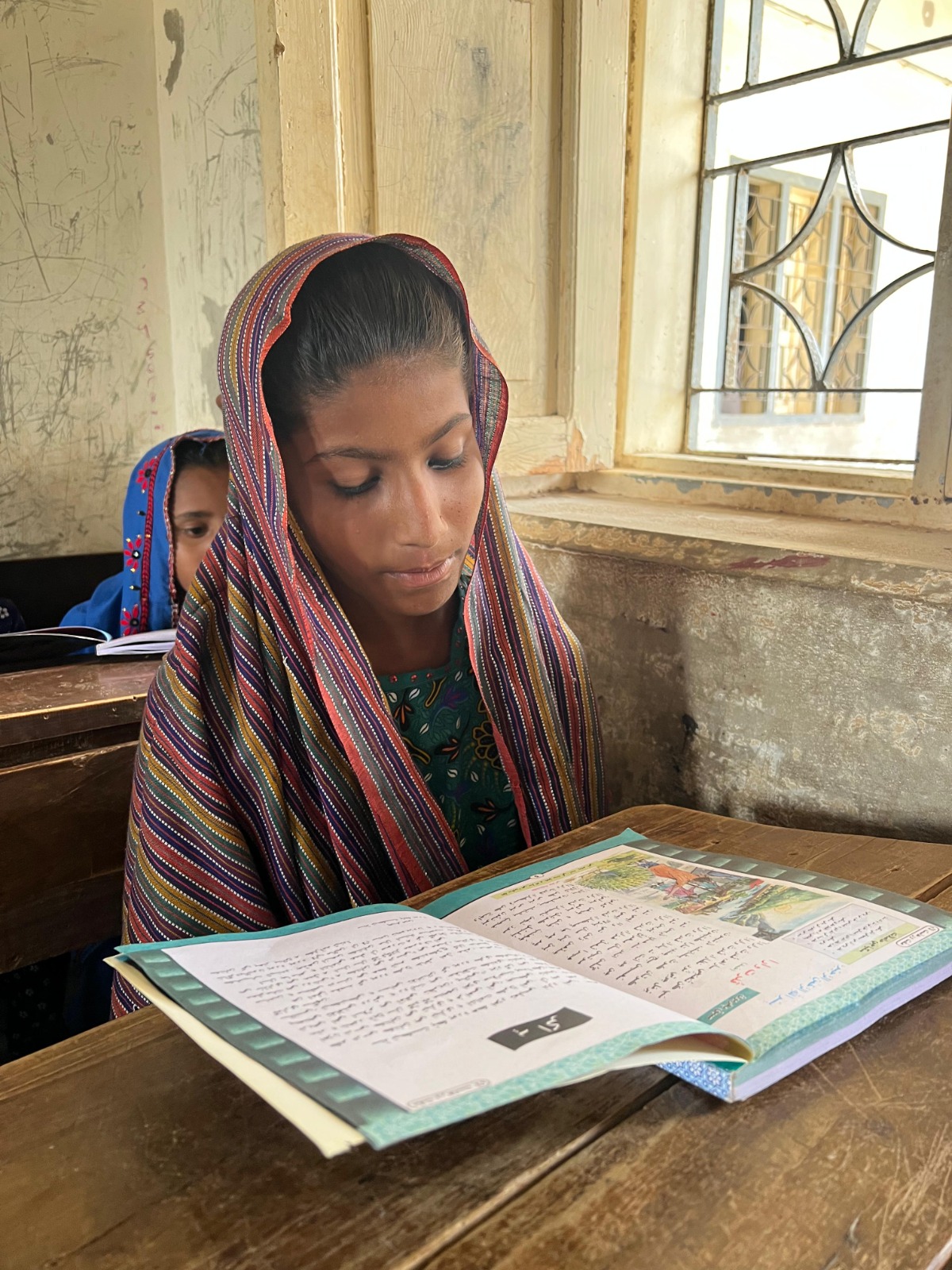

Zakat That Change Lives

Purify Your Wealth. Educate a Generation.

Zakat is more than a duty; it is a powerful means of uplifting lives. By giving your Zakat through Education Hunar and Relief Development Foundation (EHRDF), you ensure that your obligation reaches those who need it most, supporting education, dignity, and long-term empowerment across Pakistan.

- ✔ 100% Zakat-compliant distribution

- ✔ Focused on education for orphaned and deserving students

- ✔ Transparent use with measurable impact

- ✔ Trusted by local communities, educators, and donors

EHRDF is a Pakistan-based, registered nonprofit committed to distributing Zakat responsibly and transparently, strictly in accordance with Islamic principles.

Your Zakat helps break the cycle of poverty through knowledge and opportunity.

- ✔ School and university fees for orphaned and needy students

- ✔ Books, uniforms, stationery, and transportation

- ✔ Higher education and skills development programs

- ✔ Educational infrastructure in underserved areas

- ✔ Student mentorship and career guidance

Your Zakat directly supports eligible recipients through:

Every rupee of Zakat is used to restore dignity and create self-reliance.

- ✔ Cash savings (bank or home)

- ✔ Gold (Nisab: 85 grams)

- ✔ Silver (Nisab: 595 grams)

- ✔ Investments (shares, savings, business assets)

- ✔ Trade goods and business inventory

Step 1: Identify Zakatable Assets

Step 2: Subtract Liabilities

Deduct short-term debts due within the year (loans, bills, obligations).

Step 3: Check Nisab

If your remaining wealth exceeds the Nisab threshold (gold or silver value), Zakat is due.

Step 4: Pay 2.5%

Calculate 2.5% of your surplus wealth.

Example:

If gold is valued at PKR 18,000 per gram:

85 × 18,000 = PKR 1,530,000 (Nisab)

If your wealth exceeds this amount, pay 2.5% on the surplus.

EHRDF ensures Zakat is distributed responsibly and transparently to eligible beneficiaries only. Your contribution is never mixed with non-Zakat funds and is used ethically to support education for those who need it most.

Your trust matters and your Zakat changes lives.

Zakat Calculator

Frequently Asked Questions

Zakat, one of the five essential pillars of Islam, refers to a defined portion of wealth that a financially eligible (Sahib-e-Nisab) adult Muslim gives to the poor annually with the intention of fulfilling this obligation. “And in their wealth is a known right. For the one who asks and the one who is deprived.” (Qur’an 70:24–25)

Nisab is the minimum amount of wealth a Muslim must own to be obligated to pay Zakat. It applies to four types of wealth:

Gold (87.48 grams / 7.5 tolas)

Silver (312.36 grams / 52.5 tolas)

Trade goods (equivalent in value to 52.5 tolas of silver)

Cash or savings equal to the value of 52.5 tolas of silver

Beyond being a core pillar of Islam, Zakat is a divine tool for social justice that can significantly reduce global poverty and hardship. “Establish prayer and give Zakat. Whatever good you send forth for yourselves, you will find it with Allah. Indeed, Allah sees all that you do.” (Qur’an 2:110) It is also a right owed to the poor, as stated in the Qur’an (70:24–25).

Zakat is calculated at 2.5% of a Muslim’s total wealth that exceeds the Nisab threshold and has been held for one lunar year.

Zakat can be given to a Muslim who is not a Sayyid (descendant of the Prophet ﷺ) and who does not own wealth or assets equal to or above the Nisab level.

No, the obligation of Zakat is specific to Muslims only.